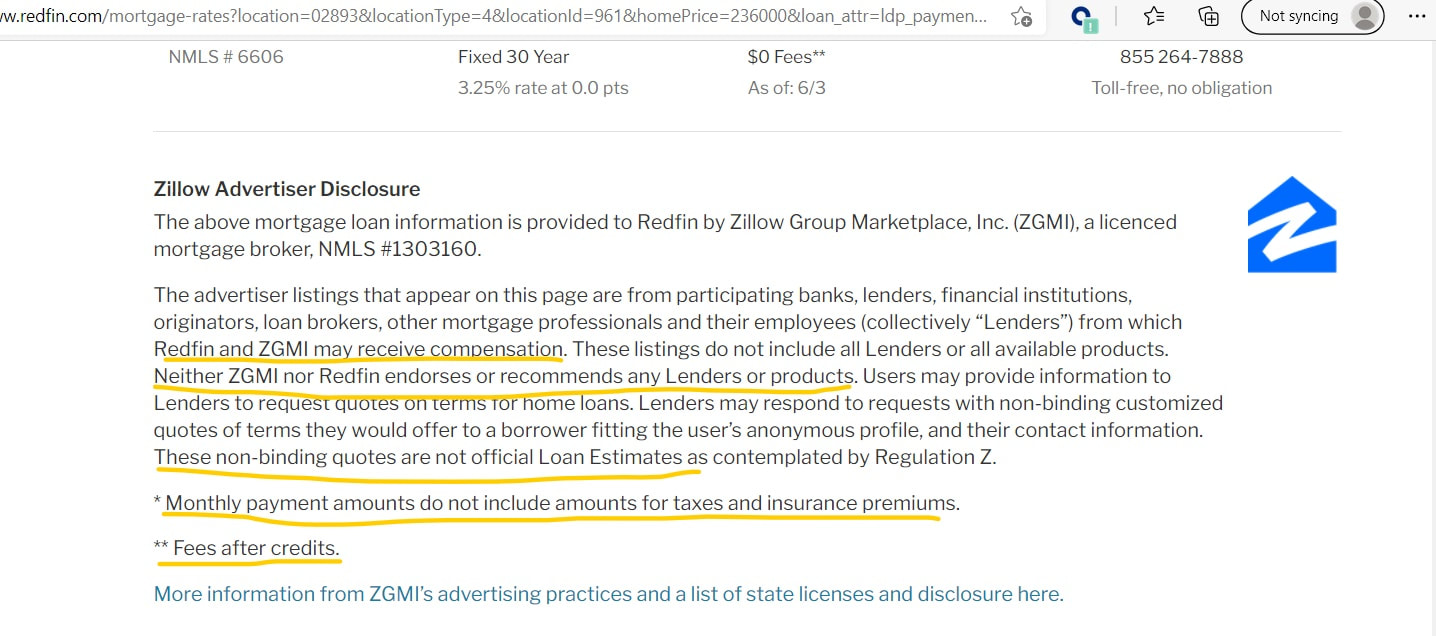

SummaryInterest rates are the subject for confusion, excitement, disappointment and panic. They truly touch on nearly every emotion. Online ads, sponsored-content articles and news headlines contribute to the confusion among borrowers. These publications and platforms don't make it clear that borrowers can't simply get the lowest possible rate. There are factors that impact their qualifying rate, and therefore borrowers should ignore the hype and learn from this article. We'll discuss what impacts a qualifying interest rate and how to be prepared for the application process. by Christian Scully As we witnessed in 2020, news headlines and online advertising are enough to stir up excitement and send borrowers shopping and applying for refinances. 2020 even saw some interest rates under 2%! What those news headlines often forget to mention is the $10,000+ in discount points you'd be paying to get a rate under 2%. Sometimes borrowers will start a conversation with me by inquiring about the current interest rates. This is not a black and white question. Those advertised rates are generally the best rate you could possible qualify for under perfect conditions. However, in the process of applying for a mortgage, other details about the transaction are filled in. Those details can trigger a "loan level price adjustment" or LLPA. LLPA's can add or subtract a small amount to the interest rate for various reasons. The most recent newsworthy example of this would be the half-point (0.5%) fee that Fannie Mae and Freddie Mac added to all refinances after 9/1/20, named the "Adverse Market Refinance Fee". In most cases, this would cause the interest rate to increase simply for the fact that the loan purpose is a refinance. Other details that will affect a borrower's qualifying interest rate include their credit score. For example, if the borrower has a 580 credit score, their interest rate will increase more than if the borrower as a 660 credit score. If the borrower is applying for a mortgage on a primary residence, the interest rate will be lower than if it is a second home. Interest rates for investment properties are significantly higher. Interest rates for multifamily properties will be higher than for single family properties. Rates for 5% down payment will be higher than 20% down payment. So the biggest problem occurs when a borrower is shopping for a single family investment property and sees an advertisement on one of the major real estate websites for super low interest rates on a 30 year fixed mortgage. The borrower will show me these ads and ask if we can match those rates, without realizing that those rates aren't realistic for their situation! Those advertised rates are assuming: 800+ credit, 20% down payment, primary residence single family. Once I add to their file that it is an investment property, the rate could easily go up 2%. Investment properties are viewed as a higher risk loan, and therefore don't offer the lowest rates. Read this advertising disclosure that appears below all of those amazingly low advertised rates: The advertised payments don't take into account property taxes and insurance. The rates they proposed are "non-binding quotes" and "not official Loan Estimates". Without an official Loan Estimate from a lender you can't know what the costs of the loan and closing the loan are. Basically, these advertised rates are meaningless and are there to attract borrowers. The problem is when borrowers get fixated on interest rate. They get focused on the number. They will want 2.99% more than 3% any day of the week, without even knowing the actual differences. And if they see 2.99% on an advertisement and then when all of their information is added to an application and rates are quoted, they will be so disappointed to see they qualify for 3.25% or 3.5% instead. This causes unnecessary stress and worry, even when the differences are miniscule. This scenario comes up time and time. It is why I wrote an article on why interest rates are not the most important thing. Read that article here. + Better Tip

If you are seeking a refinance and hear that mortgage rates are low and it might be a good time to refinance, definitely look into it. If you plan to be in the house for at least five more years, it may be worth it. In this scenario, you already know your current interest rate and would have the expectation to go at least a half point lower (if the goal of the refinance was to lower the rate and not to cash-out equity). You'd be able to talk to a lender and see if they could qualify you for a lower interest rate. Lenders are required by law to ensure there is a "net tangible benefit" to the borrower when refinancing. If there is not benefit to you, they can't sell you a loan. If you are seeking to purchase a property and are a first time homebuyer, don't go into the process with unrealistic expectations. As discussed in this article, there are several factors that may affect your qualifying interest rate that you may not be considering. The interest rate is one factor, make sure that it works within the big picture. Most importantly, make sure that your monthly payment is affordable. If you are buying a multifamily property, make sure your monthly payment accomplishes your cash flow goal. If the goal is to break even between the rental income and the monthly payment, then that's what matters. And at the end of the day, if the goal is the buy the house, then don't overthink all of these details and compare them to what you read on the internet. Make sure the loan accomplishes YOUR goals and works for YOUR finances. Comments are closed.

|

Real Estate + MoneyThoughts, ideas, lessons-learned, inspiration, how-tos and more from a journey in small business, to owning and investing in real estate, helping borrowers navigate the mortgage process as a licensed loan originator, in an ongoing pursuit to fund the life and retirement that is chosen, not accepted. |